Blockchain Bites: Australia to consult on new crypto regulatory guidance, Crypto emerges as election force signaling US policy shift, Citigroup and Fidelity test money market fund tokenisation, RWA: All your base belong to Franklin Templeton?

08/11/2024

Steven Pettigrove, Jake Huang, Luke Higgins and Luke Misthos of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Australia to consult on new crypto regulatory guidance

In a hearing of the Senate Economics Legislation Committee this week, Australia’s securities regulator, ASIC, confirmed that its expect to release a draft update to its Information Sheet 225 (its main regulatory guidance directed to crypto-assets) before the end of the year, providing new guidance on licensing requirements for digital assets. This guidance will be open for public consultation, with finalised guidance expected sometime next year.

At the hearing, both ASIC and the Treasury took questions on the current status of the legislative and policy reform agenda for crypto-assets in Australia. ASIC Chair Joe Longo confirmed ASIC’s position that its principal role in relation to crypto-assets is as a law enforcement agency charged with enforcing financial services legislation, emphasising that ASIC does not write laws but instead enforces existing ones, adapting where necessary to evolving digital asset markets.

The Chair highlighted that ASIC had taken regulatory action in relation to a number of crypto-related offerings over the last 18 months and that it expects to continue to take action to define the regulatory perimeter.

Longo also reiterated that ASIC regards certain crypto products as financial products, bringing them within ASIC’s regulatory perimeter. He noted that:

“the position we’ve taken in recent times is the [sic] um there are actually a lot of crypto products there are that are actually financial products or financial services”.

When pressed on whether certain crypto products are financial products, Mr Longo nevertheless observed that the sector is “largely unregulated”.

One critical challenge is the ambiguous status of some crypto assets. While ASIC regulates financial products and services, distinguishing between what qualifies as such remains complex, given that many digital assets do not fit neatly into existing regulatory definitions.

Mr Longo acknowledged that

“the current regime doesn’t cover all of the manifestations of this activity”

and that it is

“Parliament’s job to make the rules”.

Mr Longo further observed that while the law has not changed, the updates to INFO225 are expected to take account of market developments and recent Court judgments.

At the same hearing, Treasury representatives confirmed that draft legislation, which is expected to regulate digital asset platforms as a new licence authorisation under the Australian financial services licence framework, is presently being drafted but there is currently no timeline for release of the exposure draft. The exposure draft had previously been expected this year, but appears to have been delayed by other urgent legislative priorities.

While the Government has committed to passing crypto regulation, the timeline for such legislation appears increasingly uncertain with another Federal election looming before September next year.

Written by Steven Pettigrove and Luke Misthos

Crypto emerges as election force signaling US policy shift

The stunning win by the Republican Party led by former President Donald Trump will be closely examined in the coming days, particularly given the significant margin of victory. One key element may well be found to be crypto.

The numbers leading into the election and post election are interesting. Public Citizen reported in late August that crypto companies had donated 48% by value of all corporate donations in 2024.

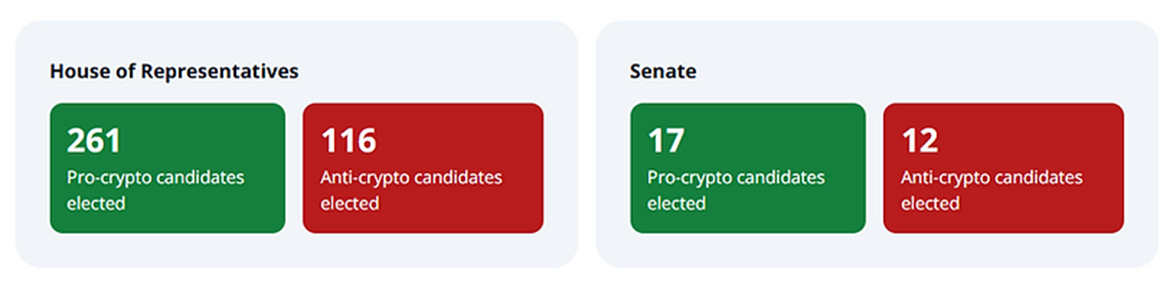

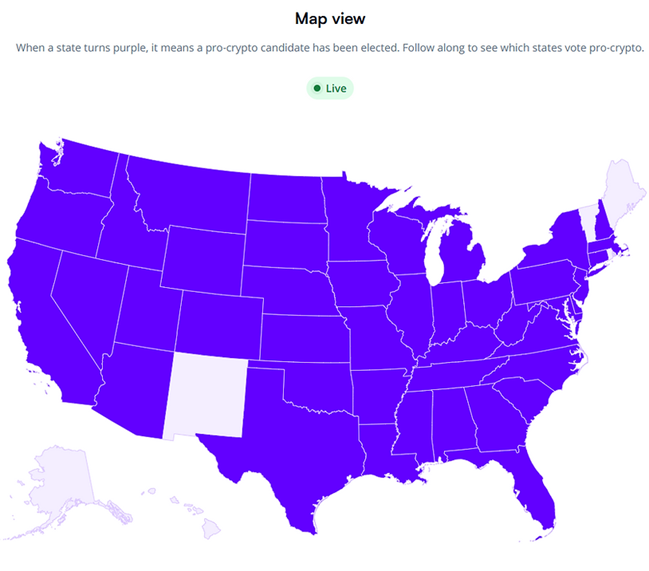

Stand with Crypto (SwC) reported that over US$200M was donated up to the election. SwC also has published extensive ratings on how friendly towards crypto different politicians are, and while there was criticism after they rated Kamala Harris a “B” (later changed to N/A), their ratings have been lined up against the election winners to show a markedly more pro-crypto legislature with almost every state of the US electing a Congressperson or Senator deemed to be ‘pro-crypto’:

Next up, what has Donald Trump promised to do for the crypto industry? Below are his promises and time will tell whether he delivers, but in a one case the timeline for delivery is very close:

- “on day one I will fire Gary Gensler and appoint a new SEC chair”;

- The USA will not sell any Bitcoin it holds (noting that President Biden or agencies may make the decision on any sales prior to Trump being inaugurated);

- The USA will establish a Bitcoin strategic reserve;

- He will support the right of Americans to self-custody their crypto; and

- He will not permit a CBDC which would let government control citizen spending.

On the subject of crypto, the Republican Party’s platform similarly promised:

Republicans will end Democrats’ unlawful and unAmerican Crypto crackdown and oppose the creation of a Central Bank Digital Currency. We will defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their Digital Assets, and transact free from Government Surveillance and Control.

Whatever views you have on Trump as a person, his pro-innovation policy position towards crypto had an immediate price impact when it became clear he would win the election, and a crypto powered prediction market was calling the election well before mainstream sites (Australian betting sites also displayed odds that Trump would win well before the media called the election).

With election data indicating that the Republicans may also control both houses of Congress, the prospects of comprehensive crypto legislation also appear brighter. This follows the passage of the FIT21 bill in the House with significant bipartisan support in May this year.

What does this mean for the rest of the world? With one of the largest markets for crypto seemingly on the path to be open for business again, jurisdictions that have followed a regulation-by-enforcement path may quickly find that the SEC embarks on a swift course correction in line with the new administration’s priorities. With the United States and SEC also having significant influence in intergovernmental bodies like IOSCO (the International Organisation of Securities Commissions), having previously driven its policy work on DeFi, we may see knock impacts in other jurisdictions as regulators seek regulatory alignment across jurisdictions.

While the Australian government has committed to implement crypto legislation to protect consumers, there is currently no timeline for release of exposure draft legislation or its review by Parliament. With a Federal election expected next year, it remains to be seen how the latest US developments will impact legislative and policy developments closer to home in the coming months.

Written by Michael Bacina and Steven Pettigrove

Fund Tokenisation: Citigroup and Fidelity bringing high fidelity and uptown funk to MMF with FX swaps

Aligning with the start of the Singapore FinTech Festival, market giants Citigroup and Fidelity have announced that they are launching a proof of concept of an on-chain money market fund which includes a digital foreign exchange swap solution and real-time settlement as part of the Monetary Authority of Singapore‘s Project Guardian. Sadly the project has nothing to do with Bruno Mars.

Joining others in bringing tokenized money market funds to blockchain technology, the additional swap and real-time settlement around this proof of concept promises to help drive “seamless and real-time settlement of multi-asset position in different currencies”.

This increased speed could create additional avenues for treasury management services to access USD yield in particular while managing non-USD funds.

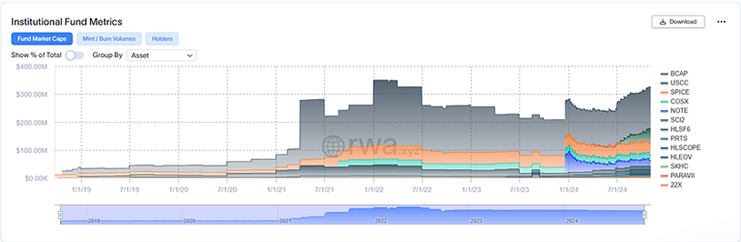

There has been a trickly of tokenization of money market funds to date (Franklin Templeton being noteworthy for traversing multiple blockchains with their fund), with other real world assets testing how tokenization might improve efficiency and automation, lending and distribution of these products. No prevailing models have emerged as standard yet, with USA, Singapore, Cayman Islands and British Virgin Islands hosting many of the top institutional tokenized funds to date.

RWA Tokenized funds (https://app.rwa.xyz/institutional_funds)

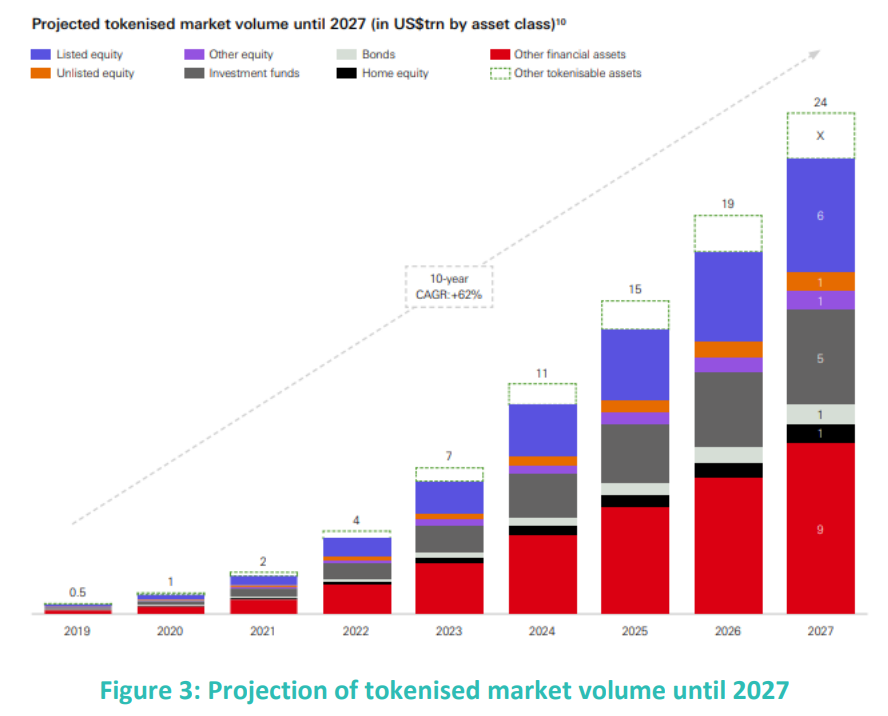

With huge projections for a move to tokenisation, with promises that banks can save up to US$20B per year and that more retail investors will gain access to products previously only available to sophisticated, wholesale and accredited investors, the tokenisation journey has huge potential, and no doubt some twists and turns, in the near to mid term.

https://www.theia.org/sites/default/files/2023-02/Tokenised%20funds%20-%20Operational%20%26%20cost%20differences_0.pdf

https://www.theia.org/sites/default/files/2023-02/Tokenised%20funds%20-%20Operational%20%26%20cost%20differences_0.pdf

Written by Michael Bacina

RWA: All your base belong to … Franklin Templeton?

70 year old NY giant Franklin Templeton has launched their substantial US$410 US Government Money Market Fund (FOBXX) on Coinbase’s Base Blockchain, extending the fund beyond the other 5 chains which were offering the fund (Arbtirum, Polygon, Avalanche, Aptos and Stellar. This is the first fund of this kind to launch on Base.

Base was launched in 2022 as a Coinbase operated layer 2 which has leveraged the Coinbase brand to become one of the fastest growing layer 2 chains with over US$8B in TVL. Layer 2 chains have been growing in popularity for application deployment as they the fees and congestion of Layer 1 chains like Ethereum (which was once famously nearly brought to a halt by Crypto Kitties’ popularity and which still has a transaction bottleneck) by rolling up transactions and writing a single record to the layer 1 chain.

This approach of having greater speed and lower costs has not been overlooked by the traditional finance industry, with more than half of the Fortune500 actively exploring or looking to web3 options, with layer 2 integrations being top of the list.

CoinTelegraph reported that Anthony Bassili, head of tokenisation at Coinbase said:

Financial institutions like Franklin Templeton are increasingly taking advantage of fast, low-cost onchain technology to modernize the financial system

With more and more real world assets moving towards blockchain systems and crypto ETFs continuing to grow, it looks increasingly like the mainstream adoption of blockchain technology will be more likely to take off in 2025 than in prior years.

The only question will be how much of it’s original libertarian roots will remain as the traditional end of town keeps arriving.

Written by Michael Bacina