Blockchain Bites: Can blockchain improve democracy? AUSTRAC sharpens focus on crypto exchanges, FTX bankruptcy sues Binance over collapse

15/11/2024

Steven Pettigrove, Jake Huang, Luke Higgins and Luke Misthos of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Can blockchain improve democracy?

Following on the heels of the US presidential election, the Royal Melbourne Institute of Technology (RMIT) Blockchain Innovation Hub has published a paper titled Democratic governance and blockchain governance: Is reconciliation possible? exploring the potential for using blockchain to improve current democratic governance systems. This is timely given the wealth of assertions of potential fraud prior to the 2024 US election, and ongoing suggestions by the losing side that there are discrepancies in the vote tallies.

The authors focus on the application of Decentralised Autonomous Organisations (DAOs) in democratic governance. In a previous paper, the RMIT team identified DAOs as adaptive governance engines which offer a dynamic low cost collective decision-making infrastructure. The paper argues that core attributes of DAOs nevertheless clash with the foundational principles of democratic governance but if a way to successfully integrate blockchain technology and DAOs into the democratic electoral process can be found, DAOs could serve alongside existing traditional governance systems and offer alternative frameworks for collective action.

What are DAOs?

DAOs are blockchain-based systems that enable people to govern themselves mediated by a set of self-executing rules deployed on a public blockchain

The authors argue that by introducing blockchain tools like token-weighted voting, smart contracts and permissionless participation, political transaction costs can be reduced. Moreover, DAOs offer a framework where actions and votes are coded publicly on-chain, potentially increasing trust and reducing claims of fraud.

DAOs vs democracy

One of the main distinctions between DAO governance and democratic governance is the nature of participation and identity verification. In traditional democratic systems, governance rights are linked to citizen-based identities and strict regulations around participation to ensure accountability, equality and transparency.

Most DAOs today rely on pseudonymous and token-based identities where governance rights flow from token ownership rather than verified personal identity (but also exhibit practically very low voting rates). This approach grants anyone with tokens the ability to engage without requiring central authorisation or identity verification. The authors argue that while this model promotes openness and flexibility, it can also promotes plutocracy, where the wealthiest token holders wield the most influence, challenging the principles of “one person, one vote” found in democratic systems.

Challenges to integrating DAOs in democratic systems

To successfully integrate DAOs into democratic governance structures, the authors suggest either placing restrictive limits on core DAO features or fundamentally transforming the democratic process.

However, imposing centralised controls, identity verification or permission layers on DAOs risks stripping them of their flexibility and decentralised characteristics, rendering them similar to traditional databases, albeit much more secured versions.

As an alternative, the authors proposes that DAOs might serve as an alternative governance model rather than replacing democratic structures, allowing them to evolve organically. The concept of the “network state” championed by the well-known investor, Balaji Srinivasan is held up as an example of this experimentation. The network state offers a vision of governance based on participation rather than citizenship and more dynamic governance structures.

Conclusion

This paper provides a thought-provoking analysis of the possibility for DAOs to revolutionise collective decision making processes alongside existing democratic governance structures. This evolution could allow DAOs to continue experimenting with decentralised governance, potentially paving the way for new forms of digital, community-oriented governance that align with emerging societal values and technological capabilities.

Written by Jake Huang and Steven Pettigrove with Michael Bacina

AUSTRAC sharpens focus on crypto exchanges

AUSTRAC is hosting its 2024 AML/CTF Advisers Forum in Melbourne and Sydney this month where discussions shed light on the regulatory priorities of Australia’s principle money laundering regulator.

Buoyed by the potential US policy shift following the Presidential election, the crypto market has rallied, meaning that increasing adoption of Digital Currency Exchanges (DCEs) and cryptocurrency flows will likely present enhanced scrutiny of AML/CTF compliance.

Recent comments from AUSTRAC highlight the critical areas of concern in this rapidly evolving space, signaling greater scrutiny and potential areas for enforcement.

AUSTRAC’s 2024 National Risk Assessment highlighted DCEs as a sector facing both heightened risks and growing regulatory attention. AUSTRAC has identified the criminal misuse of DCEs as a key concern.

criminal use of digital currency, digital currency exchanges, unregistered remitters and bullion dealers is increasing.

It is worth noting that DCE’s services for “store of value” and “conversion” are listed in the AUSTRAC report as a “medium” risk, with lawyers, companies, trusts and DCE services for “transfer of value” being rated “high” risk. Cash, property and luxury goods are rated as “very high” risk by AUSTRAC.

The report, however, makes a questionable assertion that:

Technologies that can include end-to-end encryption and digital currencies allow money launderers to hide their identities and illicit activities from law enforcement agencies.

It is well documented by crypto tracing companies that digital currencies do not allow the hiding of criminal identities and that it is in fact easier to trace and identify users of digital currencies than bank account holders or those dealing in cash. The report does go on to note:

Criminals laundering in the digital currency market use unsophisticated methods to move funds offshore quickly…Criminal groups’ persistent reliance on the traditional fiat economy means regulated on and off ramps will continue to be used to cash out of digital currency. This will allow law enforcement visibility of regulated cash-to-digital currency activity conducted through DCEs.

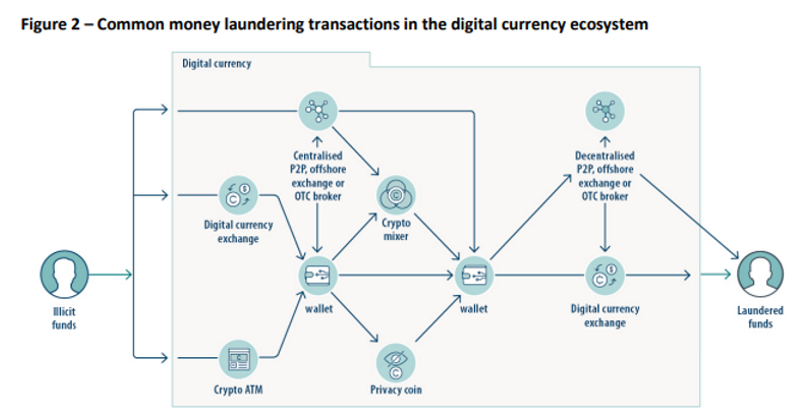

AUSTRAC highlights a common flow of illicit money laundering using digital currencies they have observed, which is worth noting would be more expensive and slower to uncover if it involved traditional bank accounts:

The assessment of increasing money laundering risk in digital assets has been reflected in AUSTRAC 2024 regulatory priorities. In recent times, sanctions compliance by DCEs has also come into increasing focus with new guidance being issued by the Australian Sanctions Office.

As a supervisory matter, AUSTRAC has strengthened its engagement with DCEs, focusing on how both on-chain and off-chain monitoring can identify suspicious activity. AUSTRAC is also seeking to understand transaction monitoring protocols within DCEs, emphasising the importance of robust, tech-enabled systems.

Another area of focus is cryptocurrency ATMs, which combine the risks associated with both cash and digital transactions. AUSTRAC is specifically wary of how these ATMs might facilitate money laundering. The UK’s recent clampdown on unlicensed crypto ATMs reflects a similar focus internationally.

AUSTRAC’s renewed attention on DCEs comes ahead of planned reforms to AML/CTF laws introduced into Parliament and expected to come into force in early 2026. These reforms will bring a number of new sectors within the AML/CTF regime while re-designating DCEs as VASPs and adding a number of new crypto related designated services. The definition of digital currency is also set to be expanded.

In that context, industry can expect an increase in regulatory scrutiny in the coming years. In the short term, the focus will be in areas like transaction monitoring and crypto ATMs, as AUSTRAC works to uphold Australia’s commitment to a transparent and secure financial ecosystem.

Written by Steven Pettigrove and Luke Misthos with Michael Bacina

Clash of Titans: FTX bankruptcy sues Binance over collapse

In the latest legal twist in the FTX bankruptcy, the trustee’s have filed a lawsuit against Binance and its former CEO, Changpeng Zhao (known as “CZ”), seeking damages over the USD$1.8 billion sale of Binance’s stake in the exchange and alleged involvement in its subsequent collapse. The suit alleges that FTX’s funds were fraudulently transferred to Binance in a 2021 share buyback deal, orchestrated by former FTX executives, including Sam Bankman-Fried. The complaint also makes various allegations of misrepresentation, fraud and injurious falsehood over Binance and CZ’s conduct in the final days before its collapse.

Background

The lawsuit relates to Binance’s 2019 investment in FTX, which it later agreed to sell back to the company in 2021. According to FTX’s lawsuit, its affiliated trading arm, Alameda Research, funded the deal using customer deposits, tokens, and overvalued digital assets. At the time, FTX was allegedly insolvent, and its bankruptcy administrators now argue that it could not have legitimately afforded the transaction.

They claim that this buyback weakened FTX’s financial stability, ultimately deepening its financial woes and setting it on a path toward collapse in late 2022.

FTX’s bankruptcy administrators argue that recovering these funds is critical for compensating its creditors, and they are also seeking punitive damages from Binance. Binance denies the allegations, stating they are “meritless” and promising a rigorous defense. Given there have been prior statements that all customer creditors will be paid 118% of their claims full from assets presently held in the estate, it’s unclear what the proceeds of any lawsuit will be put towards, but perhaps they can help defray the ongoing legal costs.

A competitive history

The lawsuit highlights the fierce rivalry between Binance and FTX, two of the largest cryptocurrency exchanges at the time, competing in a rapidly expanding but volatile market. In November 2022, as rumors began circulating about FTX’s liquidity, CZ publicly announced that Binance would liquidate its holdings of FTX’s native token, FTT. The announcement triggered a cascade of customer withdrawals from FTX, contributing to the exchange’s liquidity crisis. Binance then made a conditional offer to buy FTX subject to due diligence but determined not to proceed. Within days, FTX filed for bankruptcy.

FTX’s lawsuit claims that Zhao’s announcement was part of a coordinated effort to destabilise the exchange (and going as far as to say CZ conducted a campaign to “destroy” FTX), citing massive customer withdrawals and FTT’s plummeting value. They argue that Zhao’s statements and actions undercut any chance FTX might have had to secure emergency funding or stay afloat.

Intent and the Challenge of Proving It

FTX’s legal team face an arguably herculean task in proving that Binance (and by extension, CZ) intentionally aimed to harm its rival, especially in a competitive industry known for sharp moves between firms. The case will likely turn on any evidence of intent, including internal documents and testimonies, that might demonstrate whether Binance (and CZ) deliberately sought to harm FTX for their own gain.

Beyond the immediate legal battle, this case emphasises the need for more robust governance and transparency in the sector. FTX’s use of customer deposits, its opaque financial practices, and the lack of internal oversight all played a part in its downfall, and critics argue that stronger regulatory frameworks might have prevented its collapse.

Conclusion

As the lawsuit unfolds, it will not only shed light on the events leading to FTX’s bankruptcy, but may also underscore the risks inherent in an under-regulated crypto market where competitive pressures and financial misconduct can spell disaster.

Written by Steven Pettigrove and Luke Higgins with Michael Bacina