Blockchain Bites: Trump Announces Virtual Fort Knox with Crypto Strategic Reserve, The Future of AI and Taxation, Hong Kong issues regulatory roadmap for virtual assets, SEC drops numerous crypto prosecutions

07/03/2025

Steven Pettigrove, Jake Huang, Luke Higgins and Luke Misthos of the Piper Alderman Blockchain Group and Christian Febrraro from our Corporate team bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Trump Announces Virtual Fort Knox with Crypto Strategic Reserve

President Donald Trump has announced that five cryptocurrencies will be included in a “Crypto Strategic Reserve”. The move signals a continuing shift in the US government’s stance towards cryptocurrency, with Trump promising to position the United States as a global leader in crypto.

Two hours later, following a notable omission of bitcoin and Ethereum in the initial post, Trump clarified that these would be included:

The announcement woke the crypto industry out of its recent slump with the named cryptocurrencies surging following the announcement.

Trump’s declaration has ignited debate on social media, with some users advocating for a bitcoin-only reserve.

The announcement follows Trump’s previous commitment at the Bitcoin Nashville where he pledged to establish a national bitcoin stockpile and ensure that the US government retained 100% of all bitcoin it currently held (most from seizures by law enforcement) or acquired in the future. However, Trump has now shifted from advocating a “stockpile” to proposing a “reserve”. While a stockpile implies merely holding government-owned crypto, a reserve suggests acquiring cryptocurrency in regular instalments and potentially using it as a backing for other assets.

Trump’s crypto policy shift builds on his earlier executive order, “Strengthening American Leadership in Digital Financial Technology” issued in January 2025, which revoked Joe Biden’s 2022 directive on digital assets. Trump’s order also prohibited the creation, issuance, circulation and use of Central Bank Digital Currencies (CBDCs) in the United States.

It remains to be seen whether congressional approval will be needed to implement the reserve and whether the US Government is likely to intervene in crypto-markets in the short term to establish a reserve or merely retain its current holdings seized by law enforcement. Trump is set to host the first White House Crypto Summit on 7 March 2025, where more details on the Crypto Strategic Reserve and his broader digital asset policies may be revealed.

The United States is not the only country which holds significant investments or a stockpile of crypto-assets. Governments globally are increasingly interacting with crypto-assets as an investment or strategic asset or due to law enforcement seizures. A range of policy approaches are evident to date, however, Australia seems unlikely to follow the Trump administration’s move any time soon. A number of US states are also moving towards holding crypto reserves.

While some will see the move as a marker of cryptocurrencies increasing acceptance as a strategic asset in the digital economy, the precise objectives of the reserve remain unclear. Some see cryptocurrencies like bitcoin as a potential inflation hedge, although they are plainly subject to price volatility and any government intervention in cryptocurrency markets is likely to be closely scrutinised for policy and economic reasons.

The AI Taxman Cometh: The Future of AI and Taxation

Artificial intelligence is reshaping industries worldwide. According to recent research from the International Data Corporation (IDC), AI may contribute USD $19.9 Trillion to the global economy through 2030 and could help drive 3.5% of global GDP. Beyond the more obvious economic benefits of AI, the technology is often cited as having the potential to revolutionise administrative processes around the world, such as supply chain management, healthcare administration, regulatory compliance, and all aspects of taxation, from compliance to advisory and dispute resolution.

This article discusses how AI could reshape not just tax compliance but tax administration as a whole, by automating audits, assisting with record-keeping, detecting fraud, flagging risks, streamlining controversies, and improving revenue collection. With the ability to analyse vast datasets in real-time, AI may be able to identify discrepancies, flag potential tax risks, and even provide predictive insights to governments. If implemented effectively, these advancements could make tax systems more efficient and help reduce the administrative burden on taxpayers while improving compliance. However, the extent to which AI will deliver on these promises is yet to be showcased by any government.

The implementation of AI in taxation requires careful governance. Ensuring transparency, mitigating bias, and maintaining taxpayer privacy are critical challenges that tax authorities must address. Further, while AI is frequently promoted as a tool for efficiency, questions remain as to whether AI-driven decision-making will lead to fairer outcomes or simply amplify existing systemic issues.

The Australian National Audit Office (ANAO) recently released its report assessing the Australian Taxation Office’s (ATO) capabilities to adopt AI. The audit (yes – that’s right – an audit. Taste of the ATO’s own medicine?) evaluated whether the ATO has effective governance, design, deployment, and monitoring arrangements for AI systems. While AI may present significant opportunities for tax compliance and administration, the audit highlighted areas where the ATO strategy and systems currently lack the necessary foundations for smooth AI integration.

Key findings of the ANAO’s audit of the ATO

The ANAO’s report concluded that the ATO has only partly effective arrangements in place to support AI adoption. While the agency has made progress in integrating AI into its operations, it lacks comprehensive governance structures and risk management frameworks specific to AI systems.

Governance gaps identified in the audit include the absence of clearly defined enterprise-wide roles and responsibilities, insufficient central oversight of AI use across the organisation, and the need for a dedicated AI risk management framework. The ATO has established governance bodies to oversee AI adoption, including a Data and Analytics Governance Committee formed in September 2024 and the appointment of a Chief Data Officer as the accountable official for AI use in November 2024. However, these governance structures are still in their infancy and it is unclear whether they will be sufficient to manage the complexities of AI adoption.

The report additionally found that the ATO has not sufficiently integrated ethical and legal considerations into AI design, raising concerns about the potential for bias, privacy breaches, lack of transparency, and accountability issues.

Monitoring and evaluation were also found to be lacking. The ATO had no structured framework for regularly assessing AI models in production, with 74 per cent of AI models missing required data ethics assessments. While the agency has since developed a monthly report on AI strategy implementation, it has not yet established a structured evaluation approach. Without robust monitoring and governance systems in place, there is a risk that AI-driven tax administration could create more problems than it solves.

In response to the above, the ANAO recommended that the ATO:

- develop and implement AI-specific governance and risk management frameworks;

- clearly define roles and responsibilities related to AI oversight;

- establish formal policies and procedures for AI design, development, and deployment;

- integrate ethical and legal considerations into AI systems more comprehensively; and

- implement monitoring and reporting mechanisms to assess AI effectiveness over time.

AI and tax: global perspectives

AI is increasingly being explored as a core tool in tax administration worldwide. A recent International Monetary Fund (IMF) opinion piece highlighted how AI has the potential to improve tax compliance, fraud detection, and revenue collection. Governments globally are investing in AI-driven solutions with the aim of enhancing efficiency and improve enforcement mechanisms. However, the success of these initiatives varies significantly, and long-term effects remain uncertain.

AI systems can analyse large volumes of data to detect patterns indicative of tax evasion, fraudulent claims, or underreported income. Machine learning models can assist in identifying high-risk taxpayers, allowing tax authorities to allocate resources more efficiently. Where AI is deployed to analyse blockchain transactions, it could offer a powerful (even draconian) tool to analyse transaction information, automate collection, and audit tax compliance.

The IMF article contends that AI can assist tax authorities by enabling real-time risk assessments, providing early warnings for potentially non-compliant behaviour. AI’s predictive capabilities could also assist tax authorities to forecast revenue more accurately. That said, predictive analysis carries risk, including the potential for over-reliance on models that may not be the most accurate or unbiased.

A recent article by Ernst & Young gave an example of how generative AI (Gen-AI) could assist accounting and audit functions:

AI IN PRACTICE: It can take multinational companies weeks, multiple team members and laborious manual processes to map general ledger (GL) accounts for tax purposes. The steps generally include extracting the data from multiple countries and populating spreadsheets, manually mapping the GL accounts into a database, identifying inconsistencies among countries and issues to report back to countries, correcting errors, repopulating the database manually and then finally having a team leader review the results. GenAI-assisted automation can streamline this process into just a few steps… …[i]n this way, a labor-intensive task can be transformed into an automated, two-day process supplemented by human review.

In advance of tax controversy matters, generative AI can help tax professionals to identify, react to and report on potential areas of controversy risk…

Another application of AI in tax administration is automated decision-making. Many tax agencies currently use AI-powered chatbots and virtual assistants to provide taxpayer support, reducing the burden on human staff. However, this again raises risks, particularly if taxpayers lack the ability to challenge AI-driven determinations (can you imagine?). In Australia, taxation systems rely on the Commissioner of Taxation to exercise certain discretions to alleviate unjust or unique situations where the tax provisions were never intended to apply. It is unclear how and if AI can be adopted in such circumstances.

In essence, the use cases of AI in professional tax services (be it tax compliance, controversy, or advisory) are numerous. However, AI systems must be transparent and explainable, as bias in AI models can lead to disproportionate scrutiny of certain taxpayers or industries (for example, unfairly negative connotations and sentiment surrounding certain investment classes) which may lead to overly conservative or overly risky positions. Additionally, the integration of AI into tax systems must comply with data protection regulations to prevent breaches of taxpayer privacy.

The future of AI in tax

Despite these challenges, AI is expected to play an increasingly important role in tax administration and professional taxation services. As AI technology continues to develop, its potential to streamline processes and enhance enforcement remains a key area of focus. However, whether AI will ultimately lead to fairer or more effective tax administration depends on the safeguards and governance measures implemented. Businesses and governments (including Australia’s) will need to ensure that AI is deployed responsibly, with careful attention to fairness, transparency, and accountability, rather than simply embracing AI for efficiency’s sake.

Australia has seen the adoption of automated processes to streamline certain compliance and recovery measures in the past, including the infamous Robo-debt affair that took several years and a Royal Commission to reveal the human damage caused.

At a recent presentation at the University of Melbourne, the new Commissioner of Taxation, Rob Heferen, expressed his desire to adopt AI within the ATO’s processes and programs. The Commissioner confirmed that the adoption will ensure there is a level of standardisation amongst decisions. In a system that hinges upon taxpayer’s intentions, here’s hoping that AI is able to recognise the difference between those that are acting in good faith and those that are not.

The ANAO’s audit highlights the need for a structured approach to AI governance in tax administration. The ATO’s ongoing efforts to address these gaps will be critical in determining whether it can responsibly harness AI’s potential while mitigating its risks. AI-driven tax compliance is becoming more prevalent, but its long-term success will depend on regulatory oversight and a commitment to addressing ethical, legal, and operational risks.

“ASPIRE” for a crypto future – Hong Kong issues regulatory roadmap for virtual assets

Alongside the Consensus Web3 conference in Hong Kong (where our own contributor Michael Bacina spoke), the city’s regulator unveiled a new comprehensive roadmap with twelve initiatives seeking to “future-proof” Hong Kong’s virtual asset ecosystem and develop HK’s crypto regulatory framework.

Under this “A-S-P-I-RE” roadmap, Hong Kong’s Security and Futures Commission (SFC) proposes 12 initiatives under 5 pillars: Access, Safeguards, Products, Infrastructure, and Relationships. Below is a summary of these initiatives.

Pillar A (Access) – Streamline market entry through regulatory clarity

Pillar A focuses on fostering an inclusive ecosystem by aligning regulatory expectations with global participation. The SFC is seeking to attract qualified participants, enhance investor choice, and integrate Hong Kong with global liquidity.

Initiatives under this Pillar A are:

- Initiative 1: Establish licensing regimes for crypto OTC trading and custody services; and

- Initiative 2: Attract global platforms, order flows and liquidity providers.

Pillar S (Safeguards) – Optimising compliance burdens without compromising security

Pillar S aims to facilitate a secure and competitive cryptocurrency ecosystem by harmonising compliance requirements with competitive global standards, adopting a flexible and outcome-driven regulatory approach, and empowering market participants through clarity and proportionality. This aims to ensure robust investor protection while enabling sustainable market growth, and will need to balance compliance costs which are ultimately paid by consumers.

Initiatives under this Pillar S are:

- Initiative 3: Explore adopting a dynamic approach to custody technologies and storage ratios;

- Initiative 4: Enhance insurance and compensation frameworks; and

- Initiative 5: Clarify investor onboarding and product categorisation.

Pillar P (Products) – Expand product offerings and services based on investor categorisation

Pillar P focuses on expanding the range of crypto products and services available in Hong Kong’s regulated market, specifically tailored to meet the diverse needs of different investor categories. The SFC aims to enable risk-appropriate crypto investment tools for investors, to try and foster market development while implementing robust safeguards to protect retail investors. This approach seeks to create a balanced regulatory environment that not only encourages the introduction of innovative products but also protects retail investors from potential risks, which is a challenging line to walk.

Initiatives under this Pillar P are:

- Initiative 6: Explore regulatory framework for professional investor-exclusive new token listings and virtual asset derivative trading;

- Initiative 7: Explore virtual asset margin financing requirements aligned with securities market risk management safeguards; and

- Initiative 8: Consider allowing staking and borrowing/lending services under clear custody and operational guidelines.

Pillar I (Infrastructure) – Modernise reporting, surveillance and cross-agency collaboration

Pillar I centres on equipping and strengthening the SFC’s capability in market-wide oversight through the use of new technology tools and infrastructure building. The SFC’s vision is to consolidate cross-agency collaboration and create a prominent solution for monitoring and surveillance of risks and illicit activities in the region.

Initiatives under this Pillar I are:

- Initiative 9: Consider solutions for efficient regulatory reporting and deploy advanced surveillance tools to detect illicit activities; and

- Initiative 10: Strengthen local cross-agency collaboration and promote cross-border cooperation with global regulators.

Pillar Re (Relationships): Empower investors and industry through education, engagement and transparency

Pillar Re aims to empower both investors and industry participants through fact-based and authentic information exchanges. By equipping the public with the knowledge needed to navigate the complexities and risks of virtual assets, the SFC seeks to foster an informed community that can actively engage with this evolving landscape. The emphasis on the importance of transparency in the policymaking process also ensures that industry stakeholders are ready to contribute constructively to regulatory developments.

Initiatives under this Pillar Re are:

- Initiative 11: Consider regulatory framework for financial influencers (Finfluencers) to address new investor engagement channels; and

- Initiative 12: Cultivate sustainable communication and talent network.

The SFC says this regulatory roadmap represents a

forward-looking commitment to addressing the virtual asset market’s most pressing challenges.

The regulator also emphasises that the roadmap is not a final destination but a living blueprint, one that invites collective efforts to advance Hong Kong’s vision as a global hub where innovation thrives within guardrails. Many jurisdictions have developed roadmaps, but as is being seen in the USA now, the industry is hungry for clear rules and for practical pathways forward. HK continues towards a dual-licensing model which may well see crypto companies burdened with greater regulation than in competing jurisdictions like Singapore. If compliance and regulation does not strike the right balance, Hong Kong’s framework may not gain traction with industry and local users may continue to seek out riskier offshore providers who are not subject to any regulation, which creates a challenging environment for regulators to operate in.

SEC drops numerous crypto prosecutions

Regulation by enforcement against the US crypto industry continues to fall away. In recent weeks a raft of enforcement actions from the Securities and Exchanges Commission (SEC) have been ended, we summarise them below:

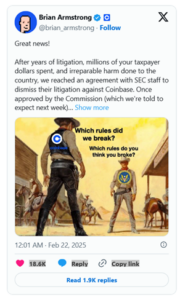

Coinbase

Coinbase CEO Brian Armstrong announced that the long-standing SEC lawsuit against the exchange will be dismissed with no penalties and with prejudice (meaning that the SEC cannot bring this claim again against Coinbase).

In 2022, the SEC began investigating Coinbase Coinbase for allegedly dealing in unregistered securities, eventually leading to a lawsuit claiming Coinbase was operating as an unregistered broker. The case became a major battleground in the broader fight over crypto regulation in the US, with Coinbase pushing back by suing the SEC for failing to provide clear regulatory guidelines – An action Coinbase eventually won.

After a prolonged legal battle, the SEC has now backed down, agreeing to a full dismissal with $0 in fines.

The SEC’s retreat extends beyond Coinbase however:

OpenSea

NFT marketplace OpenSea was also under scrutiny after receiving a Wells Notice, signaling potential enforcement action for allegedly offering unregistered securities. However, OpenSea CEO Devin Finzer announced on X (formerly Twitter) that the SEC has closed its investigation with no enforcement action.

Robinhood and Uniswap

Similarly, Robinhood and Uniswap, both of which had faced SEC scrutiny for their crypto-related offerings, have seen cases against them dropped. In the case of Robinhood a Wells Notice had been previously issued alleging that Robinhood had been listing securities on their platform. Dan Gallagher, Chief Legal Officer at Robinhood said:

We applaud the staff’s decision to close this investigation with no action. Let me be crystal clear—this investigation never should have been opened. Robinhood Crypto always has and will always respect federal securities laws and never allowed transactions in securities. As we explained to the SEC, any case against Robinhood Crypto would have failed. We appreciate the formal closing of this investigation, and we are happy to see a return to the rule of law and commitment to fairness at the SEC.

Gemini

A probe into Gemini was also dismissed with Cameron Winklevoss saying on X:

The SEC cost us tens of millions of dollars in legal bills alone and hundreds of millions in lost productivity, creativity, and innovation…The SEC’s behavior in aggregate towards other crypto companies and projects cost orders of magnitude more and caused unquantifiable loss in economic growth for America.

A shift in approach?

The dismissal of these cases suggests a broader policy shift within the SEC, signaling that its aggressive regulatory stance may be winding down.

While the SEC appears to be stepping back from its contentious “regulation by enforcement” approach, it is not abandoning oversight entirely. Instead, the agency has announced the creation of a new Cyber and Emerging Technologies Unit, which will focus on combating fraud in digital assets rather than pursuing regulatory actions against legitimate crypto firms. This could mark a shift towards a more balanced regulatory framework that targets bad actors rather than stifling innovation.

These rapid developments suggest that the SEC, under acting Chair Mark Uyeda may be retreating from its heavy-handed enforcement strategy that has dominated the past few years. The crypto industry has long called for clearer regulatory frameworks, and the swift resolution of these cases could signal a willingness to engage in more constructive policymaking.

This hopefully marks the death of regulation by enforcement in the US and the beginning of a new era of crypto regulation—one focused on transparency, engagement, and fraud prevention rather than indiscriminate crackdowns. This doesn’t mean that crypto is legal in the USA, and there will be some delay before any possible crypto legislation/regulation is considered by Congress.