Trade Marks and Blockchain: Technology Update

01/07/2019

Michael Bacina recently presented at the 10th Annual Trade Marks and Patents Conference in Sydney to explain blockchain technology and how it is affecting trade marks.

This article includes key takeaways on upcoming Blockchain projects which will impact trademarks and patents. For the uninitiated, an introduction to blockchain is available here.

Blockchain, and distributed ledger technologies generally, combine existing technologies into a new form of decentralised network which promises to cut down on inefficient business processes and automate transactions with built in rulesets. They are at heart a form of ledger system which is revolutionary in the way that no single party controls most Blockchain networks, enabling a trust in the system, as opposed to trust in counterparties, to unlock new economic efficiencies.

Blockchains usually have the following core features

- (Trustless) – The verification of transactions in a Blockchain is effectively crowdsourced and the need for a central authority is removed, removing large costs and delays associated with bureaucracy or traditional oversight of ledgers;

- (Immutable) – Security of the data (once verified and entered) is improved with an increasing number of users (or nodes) in a network. For an attack on the system to succeed, it must hit (almost) all or a majority of nodes simultaneously. This is increasingly difficult to do, particularly where there are a large number of nodes;

- (Verifiable) – Because each transaction contained in a block is time stamped, transactions and ownership of the assets on the network are verifiable. In the context of a first to file trade mark application, the blockchain’s ability to create an immutable date of creation is a highly attractive feature;

- (Traceable) – Providing a record of transactions. A Blockchain is updated with each ‘block’ of transactions, so users can see the chronological activity for that particular blockchain, effectively creating a chain of custody for IP ownership if recorded in a blockchain; and

- (Cost) – When a new user enters a public blockchain network, that user becomes both a client and an administrator. In contrast to establishing a central bank or national registry, which effectively introduces both bureaucracy and cost, blockchain gives each user the power to transact on equal footing, as each node is part of the ecosystem and benefits from the ecosystem operating efficiently.

These benefits are difficult to conceptualise in the absence of a clear use case. CSIRO’s Data61 has identified IP management as an economic opportunity for Australia’s future, arguing that effective platforms capable of managing the provenance and integrity of IP may unlock significant economic activity and new business models.

There are several potential use cases in IP for which blockchain could provide a solution. This article describes some key proposed use cases below.

Smart contracts

Numerous commentators have suggested that the principles applying to self-executing smart contracts would be well applied to some types of licensing of trade mark rights.

As an example, consider that an IP owner wishes to license their trade mark to appear on every electronic newsletter sent to customers of a business, and instead of a fixed license fee, that business may agree to pay the IP owner a minuscule amount in the form of cryptographic token (such as bitcoin or a token redeemable for an Australian dollar) for each time a newsletter is sent with the mark included. So long as the sending data is being properly captured, such as via a smart contract sending tool, the IP owner no longer needs to monitor and audit compliance, as the smart contract can automatically record each newsletter sent, and payment for the license fee to a pre-determined wallet address under the IP owner’s control can occur.

Similarly, royalties of songs or digital media are ripe for automated processing of small payments to various parties entitled to payment without the need for aggregate collectors of royalties.

Evidence of use

The use of a trade mark is important in establishing and maintain trade mark rights. In many jurisdictions, trade mark rights accrue to the first to use the relevant mark. In all jurisdictions, rights of trade mark registration are dependent (with varying rules) on continued use of the trade mark. Often, however, proving prior use or continuing use of a trade mark is a difficult process involving arduous collection of relevant records (which can prove to be unreliable and incomplete), and demonstrating use of a trade mark can be a significant cost to rights holders.

If, using a smart contract, data showing the time, date, and circumstances of first or subsequent use is recorded on a blockchain, subject to the court accepting Blockchain based evidence as reliable (which is increasing as time passes) then a party may have a verifiable, immutable record to present as evidence. By circumventing the usual reliance on accounting records (which may not demonstrate sufficiently the actual use of the trade mark) and archived paper records, the costs of proving use may be dramatically reduced, which could lead to a reduction in the risk of challenges to registration of trade marks.

Fighting back against counterfeiting

The fight against counterfeiting, both online and for physical products, is never ending for trade mark owners. Existing indicators of authenticity (such as logos, QR codes, NFC chips, etc) while better than nothing, are relatively easily circumvented, particularly when counterfeiters can take advantage of non-comprehensive international trade mark registration.

In contrast, if a product is labelled with a unique identifier that corresponds with a record on a blockchain ledger for that specific item, it is much simpler to verify that the relevant product is legitimate and owned by the correct party, including when it has been sold. As always the “Garbage In Garbage Out” principle applies so Blockchain will only bring advantages where the sale or scanning as part of a supply chain is diligently enforced.

Trade Mark Applications

Since the emergence of blockchain technology in 2008, only about 839 trade mark applications or registrations for a mark including the word “blockchain” have been made with WIPO as at 3 April 2019. Moreover, of these 839 applications only 666 are active marks.

Perhaps unsurprisingly, the US is home to the vast majority of these applications, with 333 applications originating in the US, with only 74 originating within the EU and 27 coming from Australia. Focusing on the Australian applications, only 6 were registered, 16 were pending and 5 had lapsed according to the IP Australia register as at 12 June 2019.

Additionally, there are at least 75 live marks in the US that contains the word Bitcoin. The non-official Bitcoin advocacy group “Bitcoin Foundation” has opposed the idea of registering “Bitcoin” as a trade mark, arguing that“[Bitcoin] is a generic term like the terms used for other currencies such as “dollar”, “euro,” “yen,” etc,” and that the term Bitcoin should be preserved for public use. This concept is discussed further below.

While the small number of trade mark applications and registrations may be surprising in comparison to the degree of the emergence of blockchain technology, it should be noted that the above searches only relate to marks including the word “blockchain” and “bitcoin”. When observing the trade mark applications and registration made by Blockchain companies, numerous applications and registrations are held for marks such as “HODL”, “Binance”, “Bitfury”, “Satoshi”, “Chainalysis”, “Cryptokicks” and more.

Trade Mark Disputes

There have yet to be any high profile trade mark disputes relating specifically to blockchain in Australia, to the best of the writers knowledge. There have however been a few interesting examples overseas, mostly out of the litigious USA, including the following:

Blockchain Luxembourg SA

Blockchain Luxembourg SA filed a claim on 20 September 2018 in the New York District Court against bitcoin company Paymium SAS, claiming that Paymium SAS had infringed its logo mark which included the word “BLOCKCHAIN” by using the name domain name “Blockchain.io”. Interestingly, beyond its registered logo mark, Blockchain Luxembourg SA argued that it also had unregistered trade mark rights in the term blockchain, as follows:

“[Blockchain Luxembourg SA] does not claim exclusive rights to the word “blockchain” to describe the technology underlying cryptocurrencies, such as bitcoin, and used for virtually limitless other applications and by many industries, of which digital currency is only a small subset. Rather, it claims exclusive rights in the BLOCKCHAIN marks, which it has been using exclusively for its Blockchain Products and which have become well and favorably known to consumers throughout the United States and the world as identifying its highly regarded and secure services. As a reflection of Blockchain’s status and popularity, its website at www.blockchain.com is the first organic result of a Google search for “blockchain”

In a subsequent motion to dismiss, Paymium asserted that:

“this lawsuit is an improper grab at trademark exclusivity in the word BLOCKCHAIN, perhaps the hottest technology buzzword on the planet. While [Blockchain Luxembourg SA] were prescient and resourceful enough to obtain the domain names blockchain.com and blockchain.info, they may not properly leverage that foresight into an anti-competitive and unearned monopoly in the term.”

The claim is currently ongoing.

Alibabacoin Foundation

On 2 April 2018, Chinese e-commerce giant Alibaba filed a claim in the US against the Dubai-based Alibabacoin Foundation for copyright and trade mark infringement, after the Alibabacoin Foundation raised over USD$3.5 million in its ICO. There was no relationship between the two entities, however the Alibabacoin Foundation had the stated aim of creating an e-commerce platform using its native cryptocurrency, the alibabacoin. Initially, Alibaba’s request for an injunction to prevent the Alibabacoin Foundation from using the word “Alibaba” was rejected by the court on 30 April 2018 primarily on jurisdictional grounds, and after arguments by the Alibabacoin Foundation that it was not trying to deliberately associate itself with Alibaba, and that China’s September 2017 ban on ICO’s eliminated the main source of potential confusion between the two brands.

Ultimately, the parties settled the dispute out of court, with the Alibabacoin Foundation agreeing to change its name to the ABBC Foundation, and the parties releasing a joint statement to the effect that:

“[the parties have] reached a worldwide settlement of claims involving use of the name ALIBABACOIN, with ABBC agreeing not to use trademarks that include the term ALIBABA worldwide. ABBC regrets any public confusion that may have arisen from its former use of ALIBABACOIN.”

Telegram

Telegram, a cloud-based instant encrypted messaging company, filed a trade mark infringement claim in the US on 18 May 2019 against Florida-based company Lantah LLC. Lantah LLC had filed an application for registration of the “GRAM” mark in February 2018, claiming that it intended to develop “a virtual currency for use by members of an on-line community via a global computer network”. Telegram had not filed any trade mark applications in the US.

At that point in time, Telegram had already raised over USD$1.7 billion from a group of private accredited investors to fund the development of the ‘Telegram Open Network (TON)’, whose native cryptocurrency was to be called “GRAM”. On that basis, in its claim Telegram argued that it had acquired “common law trademark rights” to GRAM due to it already having conducted a “widely reported on and highly successful offering of Purchase Agreements” using the word “GRAM” as the proposed name of its token. In particular, Telegram argued at paragraph 43 of the complaint that:

“Lantah’s unauthorized use in commerce of a service mark that is confusingly similar to Telegram Messenger’s GRAM mark has caused and is likely to continue to cause confusion or mistake, or to deceive consumers and potential consumers, the public, and the trade concerning an affiliation, connection, or association between Lantah and Telegram when there is no such affiliation, connection, or association.”

Subsequently, the U.S. District Court for the Northern District of California ruled on 8 August 2018 that Telegram Messenger Inc. was entitled to a preliminary injunction preventing use of the “GRAM” mark by Lantah LLC as it had demonstrated, amongst other things, sufficient likelihood of success on the merits of its case and the likelihood of irreparable harm to Telegram Messenger Inc.. The matter will continue to a full hearing if not settled beforehand. At the time of writing, the “GRAM” mark remains live and in Lantah LLC’s name on the USPTO’s Trademark Electronic Search System.

Descriptiveness or “Genericide”

One of the common issues facing trade applications for various forms of blockchain and cryptocurrency technologies is whether terms such as “blockchain” or particular forms of cryptocurrency should be able to be registered. It is argued that terms such as “blockchain” are terms generally used to describe the technology (that is, they are descriptive) and that they should not be registrable unless they can be shown to have acquired a secondary meaning and become distinctive of one trader.

It appears that at this point, the US Patent and Trademark Office (USPTO) agrees, and has begun giving more “Office Action Refusals” for trade mark applications including the words “blockchain” (see here, here and here) and “cryptocurrency” (see here and here) on the basis that these words are merely descriptive.

For terms such as “Bitcoin”, the issue is a slightly different one: the argument is that, even if these terms were not descriptive, they have become generic terms used to describe the technology itself and should not be registered to one trader.

Proposals to move the trade mark register to blockchain

As of June 2019 many countries still appear unsure as to how they intend to regulate blockchain, consequently leading to uncertainty in government adoption of blockchain solutions. As this stage, the writer is not aware of any country actively pursuing the replacement of its national trade mark registry with a blockchain equivalent. That being said, some important exploratory work is being done. Below is a review of some of the blockchain projects in development by WIPO and IP Australia in particular.

WIPO

After receiving proposals from IP Australia and the Russian Federation, the Committee on WIPO Standards (CWS) established the “Blockchain Task Force” in October 2018 to consider the following:

- Exploring the possibility of using blockchain technology in the processes of providing IP rights protection, processing information about IP objects and their use.

- Collecting information about Intellectual Property Office (IPO) developments in use of and experience with blockchain, assessing current Industry Standards on blockchain and considering merit and applicability to IPOs.

- Developing a model to standardize approaches of using blockchain technology in the IP field, including guiding principles, common practice and use of terminology as a framework supporting collaboration, joint projects and proofs of concept.

- Preparing a proposal for a new WIPO standard applying blockchain technology in the processes of providing IP rights protection, processing information about IP objects and their use.

Subsequently, WIPO hosted a two day workshop on Standards for Blockchain Technology in Geneva on 29-30 April 2019. The findings and outcomes of that workshop are to be discussed at the upcoming CWS meeting in July 2019.

IP Australia projects

IP Australia has been undertaking an internal blockchain discovery process since late 2017, which is early for the Australian government.

As part of this process, IP Australia submitted a proposal to the CWS in October 2018 describing its blockchain discovery process, and setting out a conceptual work plan for the proposed Blockchain Task Force. As noted above, the proposal to establish a Blockchain Task Force was accepted, and Australia was appointed co-lead of the Task Force.

Since that time, IP Australia presented at the April Standards for Blockchain Technology workshop with further details of its Smart Trade Mark proof of concept, and has been liaising with the ISO technical committee on ‘Blockchain and distributed ledger technologies’ for which Standards Australia is the Secretariat.

Smart Trade Marks

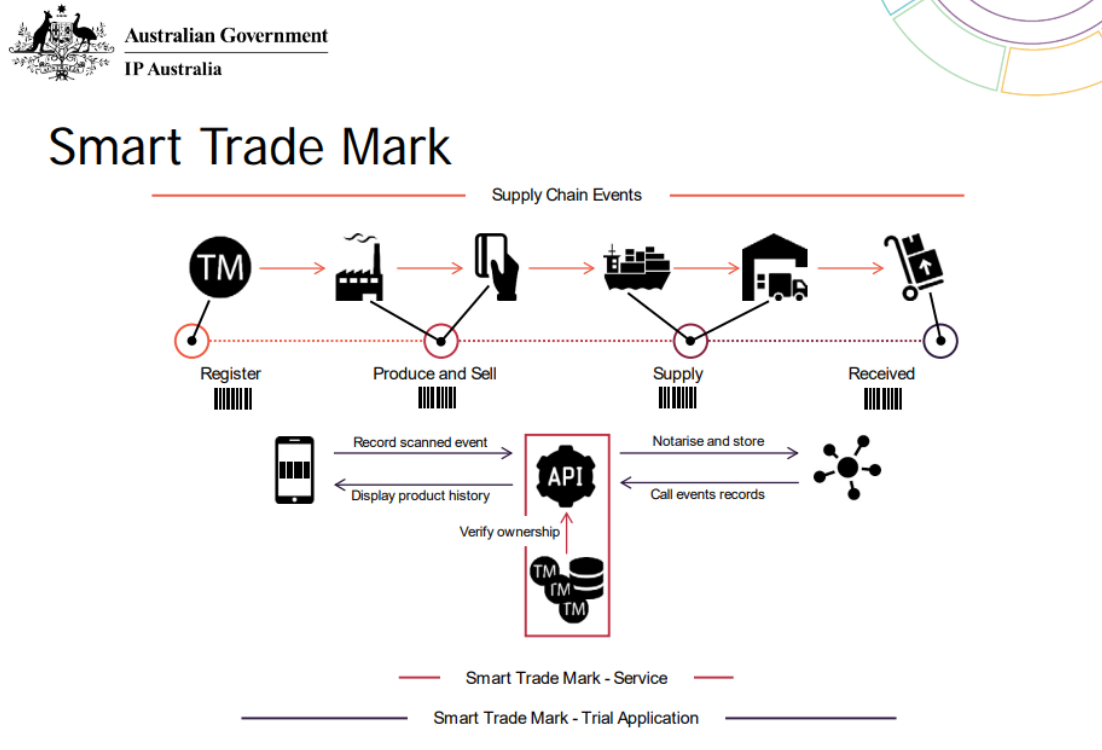

IP Australia ran a pilot for a Smart Trade Mark project in mid 2018, which was designed to allow consumers and importers to instantly check if a product has a registered Australian trade mark.

IP Australia had the following to say about the Smart Trade Mark project:

“IP Australia are developing blockchain and surrounding technologies to inform how blockchain can function in the IP ecosystem and protect IP digitally, especially in export markets. This includes targeting counterfeiting with our Smart Trade Mark API that allows consumers and importers to instantly check if a product has a registered Australian trade mark.

The Smart Trade Mark started as an innovation pilot designed from a concept often referred to as Provenance that tracks product origin through detailed and undisputable records of supply chain events. The pilot was developed utilising blockchain to notarise export supply chain events as the product moves from entity to entity then providing full visibility of the history to the consumer to confirm the products origin/provenance.

IP Australia partnered with local businesses who export to the Asia region to participate in the trial. The goal of pilot was to connect to established blockchains with minimal development effort utilising the tamperproof nature of blockchain alongside enterprise approved technologies such as APIs. Our successes in this area were recently recognised in winning the ‘Digital CBR iAward’ as well as the ‘Public sector and government’ and ‘Infrastructure and platform innovation’ awards for 2019.”

IP Rights Exchange

IP Australia has also piloted an IP rights exchange focusing on the licensing of patent rights in a decentralised marketplace in collaboration with Australian blockchain start-up Civic Ledger. As part of the trial, all patents issued in 2017 were tokenized and placed on a private Ethereum installation.

A trial was run with simple smart contracts which could be used to issue a licence upon payment and for the payment to be automatically directed to various parties without the need for any negotiations or intermediaries.

This approach has obvious limitations around what kind of licensing could be issued, but the opportunity for patent holders to effectively “name their price” and permit automatic sale of licenses with standard terms has an obvious attraction.

Back to the Future

As part of its role on the CWS Blockchain Task Force, IP Australia is establishing collaborative links with the ISO blockchain standards committee and has identified 7 core themes to be investigated further by IP Australia as part of its involvement in these processes.

While these themes are yet to be released in the public domain, they are being discussed by WIPO member states for comment, with proof of concepts being presented for those of most interest to members.

We understand that these themes and next steps will be discussed at the upcoming CWS meeting in July 2019.

Russia

Similar to IP Australia, the delegation of the Russian Federation also submitted a proposal regarding blockchain technology to the CWS in October 2018, which discussed their two key areas of focus for blockchain in IP, namely;

- information management and publication – ensuring accuracy of information used by multiple parties; and

- IP rights management, for which a prototype has been in development since November 2018.

Russia was subsequently appointed as co-lead of the CWS Blockchain Task Force alongside IP Australia.

Europe

The European Union Intellectual Property Office (EUIPO) has recently launched a new forum based on blockchain to combat counterfeiting. The advertised intent of the forum is to connect private organisations, enforcement authorities and citizens to support the identification of authentic and counterfeit goods throughout the distribution chain. Currently, the forum is focused on drafting and defining the anti-counterfeiting use case for blockchain, as well as developing a related pilot, with the ultimate goal of delivering the next level of anti-counterfeiting infrastructure based on a yet to be determined blockchain technology.

Looking to the future

The potential uses of blockchain technology in relation to the management of IP rights, by both government and business, are many and promising.

While the CWS has noted that “several [national intellectual property offices] had experiments on the use of blockchain technology for IP business” and that “some delegations stated that they have ongoing projects exploring the use of blockchain for IP purposes”, these projects have yet to be revealed, and we are not aware of their scope at this point in time.

Ultimately, many blockchain advocates will argue that a distributed ledger is capable of connecting every national trade mark registry into one aggregated database, managed by a series of smart contracts automatically. However, this dream is likely some time away.

Successful management of IP rights using blockchain requires an agreed upon and internationally supported set of standards, which is broadly accessible and meets various political as well as technical requirements.

In this way, blockchain as a technology is broadly similar to current technology systems capable of connecting registries today. The problem is, as always, the issue of aligning national and regional judicial frameworks and preferences, to which the CWS is making admirable progress.

Given the speed with which blockchain technology has been developing and the sheer volume of funding and projects being created in the space, it is an area which will be sure to continue to impact trademarks in the future.