Blockchain Bites: Telegraph Pioneer Saddles up to offer Stablecoin with Solana and Anchorage; Australia to give AUSTRAC new powers on high risk products and channels; AUSTRAC issues VASP guidance

14/11/2025

Steven Pettigrove, Luke Higgins and Tahlia Kelly of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Telegraph Pioneer Saddles up to offer Stablecoin with Solana and Anchorage

Western Union has announced plans to launch the U.S. Dollar Payment Token (USDPT), a dollar-pegged stablecoin, on the Solana blockchain in the first half of 2026. The token will be issued by Anchorage Digital, a federally chartered digital asset bank, and integrated into Western Union’s global payment network.

The initiative pairs Western Union’s cross-border infrastructure with Solana’s high-throughput public ledger and Anchorage’s regulated issuance framework. Users will access USDPT through partner exchanges and leverage Western Union’s retail locations for fiat on- and off-ramps via a companion Digital Asset Network.

Devin McGranahan, Western Union’s President and CEO, said:

As we evolve into the digital assets space, Western Union’s USDPT will allow us to own the economics linked to stablecoins. Separately, we are excited to announce our Digital Asset Network, a solution for the last mile of the crypto journey by partnering with wallets and wallet providers to provide customers with seamless access to cash off-ramps for digital assets by leveraging our global network.

Solana’s official account on X said:

Western Union is bringing USDPT to Solana—unlocking fast, low-cost global payments for 100M+ users. Built with @Anchorage, this is real-world utility at scale.

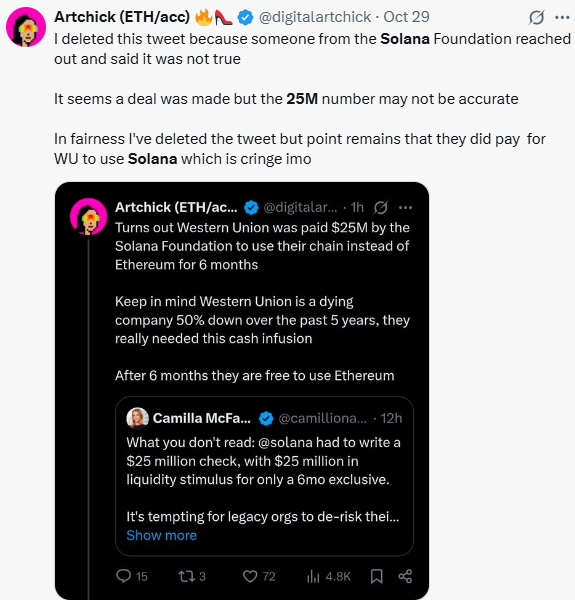

There was an initial report that Solana had contributed US $25M plus US $25M in liquidity to seal the deal, but that tweet was deleted after Solana corrected the records – something was paid it seems, which is not unusual (but which has been criticised by many online), but the amount is not known:

The move arrives alongside the GENIUS Act in the US establishing a federal framework for payment stablecoins and encourages reserve composition in cash and short-term Treasuries.

By routing settlements through a public chain, Western Union can reduce correspondent banking friction while maintaining auditability for regulators. With a huge reach of physical offices and longstanding brand, Western Union might bring savings as well as greater relevance to their business.

Ripple’s XRP Ledger, already used by Western Union via its Intermex subsidiary for on-demand liquidity, faces direct competition in the remittance corridor and raises a question of why XRP’s stablecoin RLUSD isn’t being integrated as a faster path.

The parallel deployment of USDPT on Solana highlights diverging technical choices among legacy providers, but both approaches expand the addressable market for on-chain dollars and could see the better stablecoin ultimately win. Each incremental integration strengthens network effects: more issuers, wallets, and endpoints increase the practical utility of stablecoins, accelerating their convergence with traditional payment rails and supporting broader institutional adoption.

By Steven Pettigrove

Australia to give AUSTRAC new powers on high risk products and channels

In a move to strengthen Australia’s money laundering defences, Minister for Home Affairs Tony Burke has announced proposed legislative amendments that would grant the CEO of the Australian Transaction Reports and Analysis Centre (AUSTRAC), Brendan Thomas, new powers to restrict or prohibit high-risk financial products, services, and delivery channels. The legislation would also include provisions for banks to access visa status information to help identify mule accounts.

The media release focuses on the rapidly expanding network of cryptocurrency ATMs which have become a focal point for curbing money laundering and scam operations across the country. This reflects broader efforts by regulators internationally to prohibit or restrict the offering of these machines. AUSTRAC had already taken steps under existing powers to impose additional conditions on the use of the machines.

Brendan Thomas welcomed the proposed changes, stating that the agency is prepared to act swiftly to target crypto’s integration into money laundering methodologies if Parliament passes the law.

Thomas stated:

We’re still seeing an unacceptable risk of money laundering across some channels… Having a power like this enables the CEO to adapt to the evolving risk environment in more responsive ways.

In the media release, Thomas highlighted the rapidly expanding network of cryptocurrency ATMs, which allow users to convert cash into digital currency, noting that they have surged from just 23 machines in 2019 to over 2,000 today.

AUSTRAC’s Crypto Taskforce estimates that nearly 150,000 transactions occur annually in Australia through these machines, moving approximately $275 million in value. It is estimated that 99% of crypto ATM transactions are cash deposits, which indicate a high risk for money laundering. In AUSTRAC’s sample of the 90 most frequented crypto ATM users, 85% were found to be either scam victims or money mules coerced into transferring funds.

Burke stated to the National Press Club that with these new changes:

If a bank suspects mule activity, they will be able to check visa-holder status and use this to inform decisions about whether the account is being used by criminals. It’s about equipping banks with the right information to help them manage risk, and prevent their accounts falling into the hands of criminals.

The demographic most affected are Australians aged between 50 to 70, who are believed to account for nearly 72% of transaction value at crypto ATMs. These individuals are particularly vulnerable to scams, often being coached over the phone during transactions or misled into sending money to unknown recipients.

Meanwhile, AUSTRAC has also released an updated list indicators of suspicious activity for the cryptocurrency sector

Red flags associated with crypto ATM misuse, include:

- Confused or coached customers;

- Use of flagged wallet addresses linked to scams or illicit activity;

- Multiple small-value payments or large transfers to high-risk jurisdictions;

- Transactions at odd hours or on machines without security cameras;

- Discrepancies between users and their ID photos;

- Use of multiple machines in separate locations;

- Undertakes a transaction pattern that does not match the individuals source of wealth; and

- Moving cryptocurrency to a third part wallet not controlled by the user.

The proposed powers appear to be exceptionally broad in scope, yet details remain scarce. There is no draft legislation at this stage. Legislation could give the AUSTRAC CEO the power to impose a de facto ban on certain products and types of activity, which marks a departure from AUSTRAC historic focus on close industry cooperation to target money laundering by improving AML/CTF risk management and compliance. This ambiguity raises important questions about the potential reach of AUSTRAC’s authority, and may foreshadow future disputes over legitimate space for peer-to-peer activity in decentralised finance. The breadth of the proposed power may offer valuable flexibility in addressing emerging financial crime threats, but it also highlights the need for transparency in the exercise of those powers and to balance risk based approaches to AML/CTF compliance and broader legal rights and policy goals.

Written by Steven Pettigrove, Luke Higgins and Tahlia Kelly

AUSTRAC issues VASP guidance

The Australian Transation Reports and Analysis Centre (AUSTRAC) has commenced its education efforts in the run-up to implementation of Australia’s enhanced virtual asset service provider (VASP) regime which is currently scheduled to enter into force from 31 March next year. The guidance follows:

- Substantial amendments to the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act) passed last year which include a number of new designated services for virtual assets and new compliance obligations of general application and specific to virtual assets, including new obligations to comply with the travel rule and conduct due diligence on self-hosted wallets.

- Tabling of the Anti-Money Laundering and Counter-Terrorism Financing Rules 2025(AML/CTF Rules) in September which represent a re-write of existing rules and provide important further details on how the reforms will function.

As an existing DCE or previously unregulated entity providing one or more of the newly regulated designated services, it is time to start planning for the new regime. We have previously written on some of the key questions to ask as we approach implementation of the new regime. From 31 March 2026, businesses providing certain designated services involving virtual assets with a geographical link to Australia will be subject to AML/CTF obligations. Transitional rules may extend this deadline, pending further guidance from the Department of Home Affairs.

In anticipation of these changes, AUSTRAC has released further guidance of how it will interpret and apply key aspects of the changes. While for the most part the guidance reflects the Act and its explanatory memorandum, the guidance is written in an accessible format and provides additional colour in some areas.

- What is a virtual asset?

The terms ‘virtual asset’ and ‘virtual asset service provider’ (VASP) replace ‘digital currency’ and ‘digital currency exchange provider’ and cover a wider range of digital representations of value and related services.

Specifically, a virtual asset is a digital representation of value that:

- can be transferred, stored, or traded electronically; and

- is not issued by a government body.

Examples include:

- cryptocurrencies (e.g. Bitcoin or Ether);

- stablecoins (e.g. USDC or AUDD);

- certain NFTs that function as a store of economic value, unit of account or medium of exchange (e.g. gold-pegged NFTs); and

- utility or governance tokens used in DAOs.

Exclusions from the definition include:

- fiat currencies and Central Bank Digital Currencies(defined as money for the purposes of the AML/CTF Act);

- in-game currencies;

- loyalty points

- purely collectible NFTs; and

- digital records of share ownership in a company.

- What are virtual asset designated services?

Under table 1 of section 6 of the amended AML/CTF Act, virtual asset designated services include:

- Item 50A: Exchanging virtual assets for money (and vice versa) or making arrangements for this type of exchange;

- Item 50B: Exchanging one virtual asset for another or making arrangements for this type of exchange;

- Item 46A: Safekeeping virtual assets involving the control or management of private keys

- Items 29-30: Transferring virtual assets on behalf of customers or making transferred virtual assets available to customers (Items 29–30); and

- Item 50C: Financial services related to the offer or sale of virtual assets (Item 50C).

These amendments introduce the concept of ‘making arrangements’ for the exchange of virtual assets, meaning that a VASP does not need to execute every element of the exchange (under items 50A and 50B) to be captured. Captured activities may include acting as a principal, a central counterparty for clearing or settling transactions, an executing facility, or another intermediary facilitating the transaction where such services are provided by a VASP.

Safekeeping services include controlling or managing virtual assets or private keys, including having the ability to hold, trade, transfer or spend the virtual asset according to the owner’s instructions

Notwithstanding the additional guidance provided by AUSTRAC, there are likely to be important nuances in how these definitions apply in the context of virtual assets, particularly decentralised finance and software developers. As significant and continuing penalties may apply for failing to register where required, businesses are encouraged to seek legal advice and additional guidance where required.

Businesses must complete initial customer due diligence (KYC) before providing any designated service. Separate obligations also apply to transfers of value involving virtual assets.

- The meaning of ‘carrying on a business as a VASP’

An entity is only classified as a designated service if the service is provided:

- in the course of carrying on a business as a VASP (items 46A, 50A and 50B);

- in the capacity of an ordering institution or a beneficiary institution (items 29 and 30); or

- in the course of carrying on a business participating in the sale or offer (generally) (item 50C).

In the latter case, services related to the offer or sale of virtual assets are regulated if provided by any business, even as a non-core activity, and the business need not be a VASP to be captured. A service is considered provided in the course of business if it furthers a commercial venture, even if offered for free or only once.

For example:

- A lawyer storing a client’s virtual asset cold wallet is not a VASP unless they regularly provide such services.

- A peer-to-peer platform operator enabling virtual asset exchange is likely to be considered a VASP.

AUSTRAC clarifies that the regulation does not intend to capture ancillary infrastructure, such as:

- Cloud storage operators where such services are provided by an entity not carrying on a VASP;

- Persons who solely provide a software application (such as a developer of self-hosted wallet software) but does not engage in safekeeping or administration of the virtual assets; and

- Incidental financial services such as a bank processing payment for their customers to purchase virtual assets, if the bank is not otherwise involved in the offer or sale.

In addition, AUSTRAC has issued general guidance on the travel rule including specific guidance for the virtual asset sector.

- Indicators of suspicious activity for the cryptocurrency sector

AUSTRAC has outlined a comprehensive set of behavioural and transactional indicators to help crypto-asset businesses identify potential money laundering, terrorism financing, scams and other financial crimes.

With respect to crypto ATMs, these indicators include:

- customers appearing confused or coached during transactions;

- using flagged wallet addresses;

- making multiple small payments or large transfers to high-risk jurisdictions; and

- transacting at unusual hours or on machines without security cameras.

Older Australians are highlighted as especially vulnerable, and noted to be frequently targeted by scams involving crypto ATMs.

The guidance also covers indicators for cybercrime, scams and tax evasion, including examples of using of privacy coins inconsistent with a customer profile, rapidly converting with no economic rationale and having links to darknet marketplaces.

These changes are set to come into force on 31 March 2026 for current reporting entities and VASPs, excluding threshold transaction and suspicious matter reporting which will remain the same until 2029. With just five month to go until the reforms are set to take effect, and additional changes affecting all reporting entities, the sector is likely to face a busy few months as the industry navigates the transition from DCE to VASP.

Written by Steven Pettigrove and Tahlia Kelly